We tend to be more interested in the art exhibition, and not the curator; the sports team, not the general manager.

In craft beer it is the brewery and its beer that has panache, and not what happens to that beer once it leaves the warehouse. How it came to sit on a bottle shop shelf, to appear on a tap list. That’s understandable because, well, there’s nothing particularly sexy about shipping, selling, and logistics.

However, though this may not be a perfect analogy or even a good one, it may be helpful to think of independent beer suppliers as the art curators of their industry. Like a curator, they venture into the world, select works of art (or in this case beers) cohesive with a theme, audience, perhaps worldview, then go home and present the collection.

Suppliers are superintendents of the good beer available in a given location and we, the drinkers, are at their mercy. If they don’t have it, or if they don’t sell it, we can’t buy it.

For a long time in Southeast Asia nobody drank craft beer because hardly anybody was selling or brewing it here. I have fond memories from my early ‘00s travels in the region of stumbling upon the odd local brewpub serving, say, a small-batch Schwarzbier in places like Nha Trang and Mui Ne, but back then it was mostly just regional macro lagers and, honestly, that was and sometimes still is perfectly fine. Even later, when I spent time living in Bangkok from 2008-10, aside from the traditional German beers brewed at Tawandang German Brewery—one of the happiest places on the planet—there still wasn’t any other beer on the crafty end available there.

Change was afoot in some parts of Southeast Asia by the time I moved to Singapore in 2012, which is the same year Beervana International launched out of Bangkok. While it would still take a few more years for regional craft brewing to really take off, the first wave of US and European craft breweries ready to explore the Asian market had arrived.

In Thailand Beervana was the first supplier on that wave, at first importing and distributing such US breweries as Rogue Ales, Deschutes Brewery, and Stone Brewing. Beyond the beer, though, Beervana was also the first to do cold-chain distribution which, again, not an especially sexy topic, but an important one when it comes to maintaining quality control, reputation, and trust.

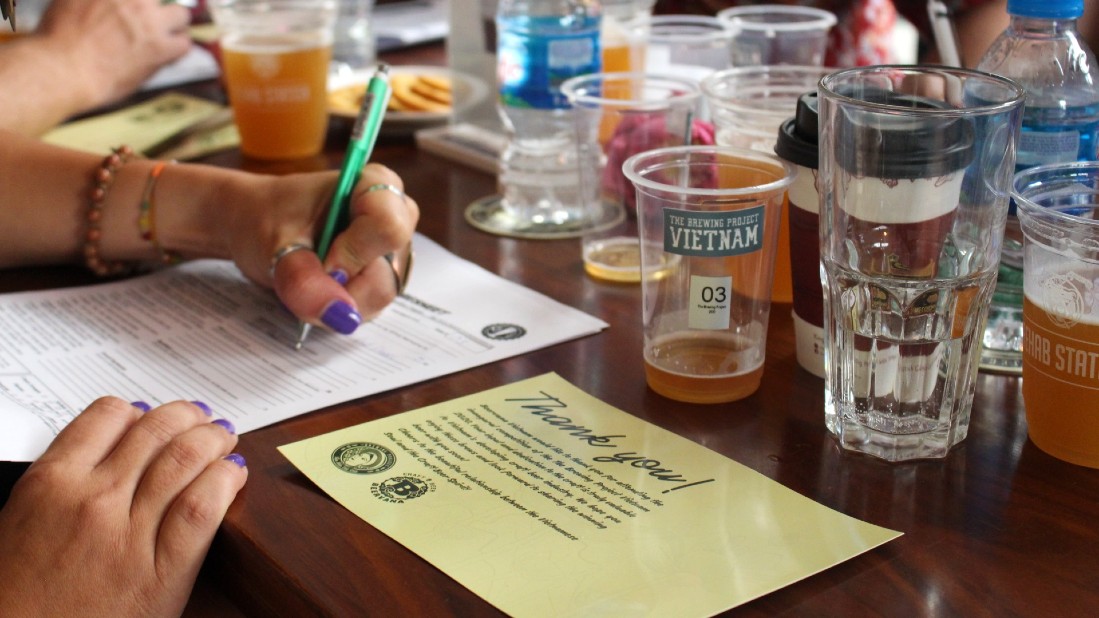

These days Beervana has plenty of competition (at least in Thailand), but remains one of the region’s most influential good beer suppliers. It now also operates in Vietnam and Indonesia, and over the years has introduced craft beer to thousands of novices in F&B through in-depth training courses. It also throws some wicked parties.

I first crossed paths with Beervana co-founders Brian Bartusch and Aaron Grieser years ago in Bangkok, and here catch up with them (and Vietnam head honcho Chad Mitchell) by email to talk, among other things, beer distribution during a pandemic and country-to-country complexities.

Beer Travelist: This pandemic has further increased discussion about global supply chains and their impact on climate change. How do these realities influence the ways in which Beervana does business?

Brian Bartusch: Our primary focus is on cold-chain imported products, so we’ve always been aware of the carbon footprint this leaves, and well before Covid-19 have always tried to reduce that footprint whenever possible. We’re always searching for the next innovations in insulated cold-chain packaging.

Things like one-way kegs, which we upcycle when they’re empty, are small ways in which we’re trying to improve. We’ve also stopped using dry ice to keep beer cold when shipping in-country, opting instead for reusable gel packs. Third-party cold-chain carriers have become more common, too, which means more beer is being transported in cardboard boxes, rather than in foam.

On a larger scale we’re in discussions with several of our brewing partners to see if it will be possible to brew some of their core products here in Southeast Asia. Ultimately this would reduce the high costs related to shipping and taxes, with the end result being fresher beer that’s in the hands of thirsty drinkers much faster and with a smaller footprint.

BT: Do you foresee regional breweries becoming a greater part of Beervana?

Bartusch: From the beginning Beervana has focused on the highest quality imported beer, but we’ve been watching closely as regional breweries have grown into their stride. We’ve worked with a few regional breweries in the past, and definitely hope to work with them more in the future to represent regional brands. We’d also like to solidify partnerships with them to brew some of our imported labels under contract.

Beer is really an agricultural product, so brewing locally would be ideal for freshness. I believe we’ll see the expansion of this concept with more overseas breweries either moving operations into the region, or contract brewing under license at local breweries.

BT: Is Beervana feeling a hit from drops in tourism? What kinds of conversations are you having with clients in the hospitality industry at the moment?

Bartusch: We’ve been hit in our tourist-specific markets, places like Phuket, Chiang Mai, and Bali, but overall we’ve been able to withstand the tourism decline since our main customers are locals and expats. Tourists are more of a bonus; they tend to go for the cheaper local beers over craft or imported beer.

Conversations with hospitality partners have ranged from outright panic to calm reassurances and everything in between. Overall, most people seem to be in some form of shock and confusion because no one knows what the fuck is coming next. It’s been a struggle to remain calm in the face of recent events, but panic and fear never really help. One comfort has been the large cold room full of beer a few steps away from my desk at the office.

BT: Is home delivery becoming more of a focus, or something the company is promoting more?

Bartusch: We’ve always focused on business-to-business (B2B) sales, so even though in Thailand we have the Craft Beer Club, which is business-to-consumer (B2C), it’s never been a large part of what we do.

We never want to bite the hand that feeds us by directly competing with our bar and restaurant clients, so we initiated a profit-share incentive program in which we’re working with our most active clients to offer their customers delivery of our products, then sharing the profits. For example, your favorite local bar or restaurant can recommend our site and give you a discount code—not only will you then get a discount on your order, but the restaurant will receive a share of the sale.

Related: Ten of Bangkok’s Finest Craft Beer Bars

As for increasing awareness, we’re doing the best we can, but alcohol advertising is extremely restricted in Thailand. Several new online delivery services have also popped up to meet the recent demand, and they are all getting the word out through various media channels.

(Ed Note: See here for a Beervana-related dive into Thailand’s draconian alcohol advertising laws.)

BT: What’s a typical order like?

Bartusch: I’d say it’s around THB1,000 (~USD$31), a mix of core beers with a couple of the newer, exciting ones. We’ve also seen a bump in the sales of glassware, t-shirts, and other merch.

BT: And how about in Vietnam?

Chad Mitchell (Business Development Manager, Vietnam): Similar to our other markets, most alcohol consumption is onsite at bars and restaurants. As in Thailand we do mostly B2B sales, which essentially dried up during the five-week shutdown. At that point we quickly pivoted to an online ordering platform and supported our B2B customers with a portion of the sales.

It was amazing to see our online orders with home delivery become the only part of our sales during that time. Some predicted that alcohol consumption would shift to home, but now that Vietnam is almost 100-percent open (aside from karaoke and dance clubs) the online orders have all but ceased. Most people are out drinking in public at about 60-percent of what it was before the lockdown, and our regular B2B partners are starting to order again.

BT: I’m guessing Indonesia is challenging. What has that experience been like thus far, and what are a few things you’ve learned about promoting craft beer in the country?

Aaron Grieser: For reference, Indonesia was the second country we opened up after launching in Bangkok in 2012; we sold our first beer here in December 2016.

For starters, the barriers to entry are insane. The juiciest sectors of the economy are protected for locals by a nonsensical thicket of regulations that essentially allow vested interests to block foreign competition. One example, in our world, is that while Thailand has literally hundreds of alcohol import licenses that are renewed annually online, Indonesia has 17—for the whole country.

An oligopoly of importers sit like a dragon at the mouth of the cave protecting its treasure, so it takes deep connections and alligator skin to deal with regulatory BS. It took us four months to go from incorporation to selling our first beer in Thailand; in Indonesia it took 18 months due to the maze of licenses and permits we needed to navigate, many of which exist solely to make sure all the departments get their slice of the pie. (It also took longer because we didn’t pay bribes.)

Once you surmount the castle wall, though, competition is… where? We’ve operated in Indonesia for more than three years now and to date we have no major competitor in imported craft beer. We literally have the market to ourselves and have had spectacular growth in sales (at least until Covid-19). Indonesia is our fastest growing market, and the innovation rate is quite low, which allows for much greater brand building.

Contrast that to Thailand, where we were also the first to introduce craft beer, but then had two competitors within six months of opening. Today there are more than 20 craft beer distributors in Bangkok alone, many of whom seem to do one-time only special releases of air-freighted beer every weekend.

The Indonesian market is also concentrated. The vast majority of Indonesians don’t drink, for religious reasons, so I’m sure we’ll never sell a beer in, say, Aceh province. Seventy percent of the premium beer market is concentrated in Jakarta and Bali, but those areas have the combined population of the entire Thai middle class and greater spending power—and they spend a lot of it on drinks.

Another funny quirk is that drinking is much more discreet than in other countries in the region, where bars openly face and sometimes fill the street. In Indonesia, drinking establishments are often secluded, tucked away in soundproof basements or rooftops… but once you’re inside, damn, it’s fun.

BT: What are some key differences you’ve found between these three markets?

Bartusch: Alcohol advertising and taxation are the obvious two that drastically change by country. I know there is a lot to unpack there, but to keep it simple, each country is very different culturally, which means they approach advertising and alcohol taxation in very different ways. Lessons learned in one region may not necessarily apply to another due to the vast differences in culture towards alcohol.

BT: Last time I saw you I mentioned how impressed I was by the depth and breadth of products Beervana has placed in some of Bangkok’s fancier supermarkets. What kind of growth have you seen there over the past few years, and is there room for more?

Bartusch: Yes, we have grown quite well into the upscale retail markets in Bangkok and beyond. That growth came in spurts as we slowly figured out which SKUs and pricing best fit the retail model, but now we’re pretty confident with the selections there.

Related: Come Hell or High Water, a One-Night Stand with Bangkok’s Craft Beer Guerrillas

We’ve seen steady growth in general, of course, and during the quarantine-isolation period there were significant increases in sales. There is definitely room for more growth in the off-premises channels here, but it will have to come with better infrastructure in the form of beer fridges. Most stores keep the majority of beer warm, with only a small area for chilled beer.

There are also the 7-Elevens you’ll find on almost every corner of the Kingdom that haven’t yet really embraced craft beer. As the local and regional breweries produce better craft brews with more favorable price points, I hope we’ll see a better selection in the busy 7-Elevens around town.

BT: Speaking of growth, we’ve both watched craft beer become an entirely different beast in Southeast Asia over the past decade. Is there anything that surprises you about how things have changed?

Bartusch: It’s been phenomenal to watch how fast the changes have come, from zero IPAs in Thailand eight years ago to today’s selection, which rivals almost any country in the world. Also seeing the rise of local homebrewers and how far they’ve come over a few short years—some of them are today producing world-class (yet illegal) brews when not long ago many of them were undrinkable. It’s also always surprising to see which trends from elsewhere take off here and which quickly fizzle and die; one example would be hard seltzers, which are all the rage in the US but failed miserably here.

BT: Related, Beervana puts a lot of resources into what we’ll call “craft beer education.” Has the message in, say, a slightly more developed market like Bangkok changed at all since you first started?

Bartusch: We’ve seen steady growth and interest in craft beer education, and have taken our beer courses to more sophisticated levels in response.

With the overall rise of craft beer in the region, we still definitely see interest in the “101” or introduction to craft beer workshops from new initiates. We’ve also seen the next level of craft beer education come through with more specific master classes and focused workshops. These days you can find a “Sour Beer & Soft Cheese” workshop in Bangkok just as easily as in Brooklyn.

Another nice development through the gradual growth of the region’s homebrewing scene has been an influx of Beer Judge Certification Program (BJCP) judges and homebrew competitions. We recently had to postpone a fully booked BJCP Tasting Exam due to Covid-19, but as soon as we’re allowed to gather again we’ll complete that one and schedule more.

BT: Any new beers/releases in Beervana’s portfolio you’re psyched about?

Bartusch: We’ve always got some new and exciting beer on the horizon—it’s one of the best perks of working in this industry! We’ve managed to keep true to our roots, so to speak, and honor the brands that we grew up with from the beginning like Rogue, Deschutes, and Stone, all breweries that have done a great job of keeping exciting new brews coming out along with their standards. I’m personally excited for the Rogue Chocolate Nitro Stout, which uses a new type of in-can nitro widget to create a frothy nitro beer.

Beyond the original breweries we’re always on the lookout for new partners on the cutting edge of craft beer. We do much smaller monthly air-freight shipments with a few pallets of super-fresh IPAs or fruit sours from breweries like Equilibrium and Barrier out of NYC, so I’m always excited to help intake those ones!

Beyond the beers, I’m ready to get back to work on some projects that were postponed from earlier this year. We were putting together a local beer fest with our friend Charlie Papazian during his annual visit, but everything had to be postponed. I was also talking with Sam Calagione and Rob Tod, but then Covid-19 pulled the rug out from under us; hopefully they’ll remember me and we can make an even better festival in 2021.

###

All photos courtesy of Beervana International, which operates in Indonesia, Thailand, and Vietnam.

This story was edited to the sounds of RTJ4.